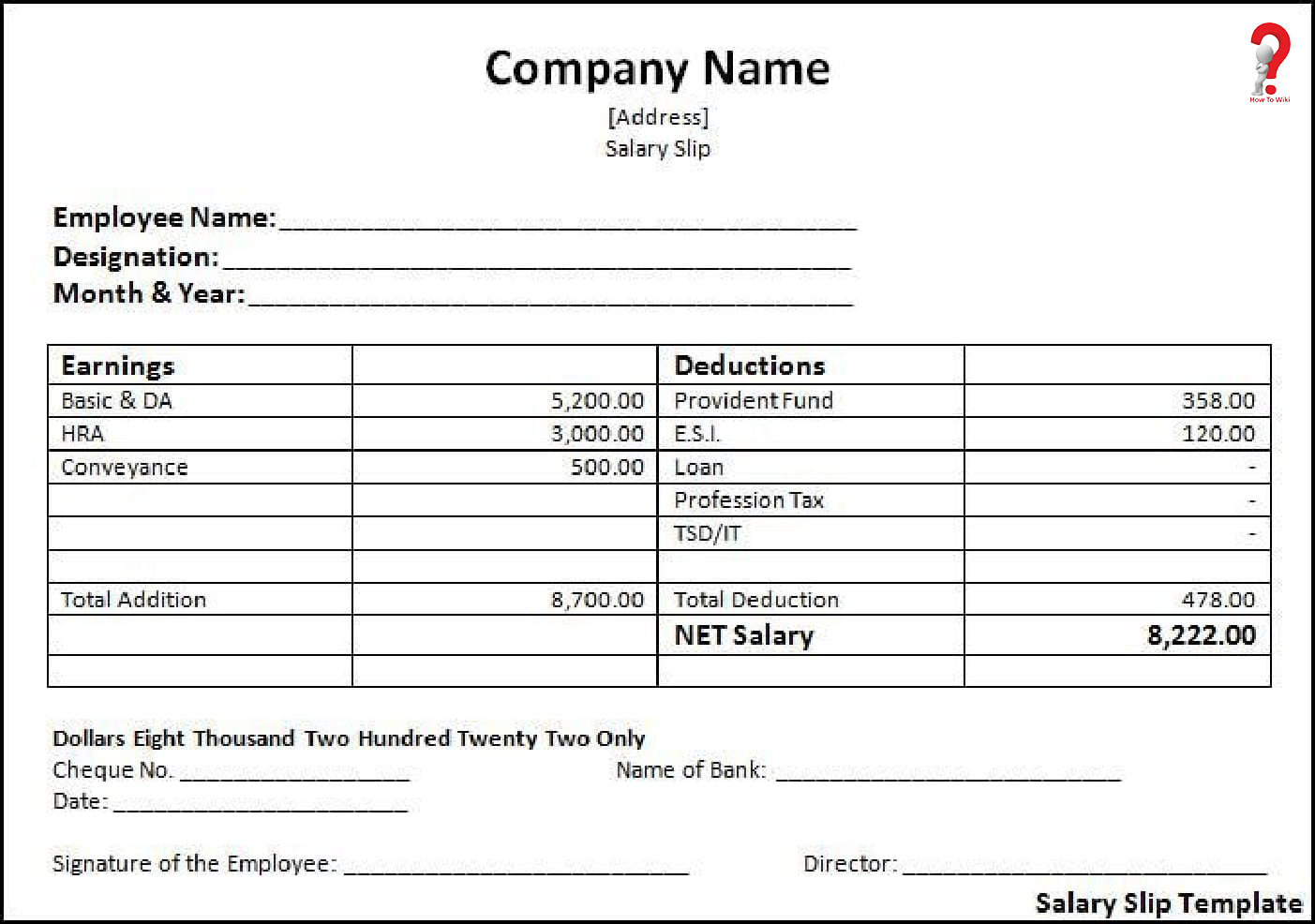

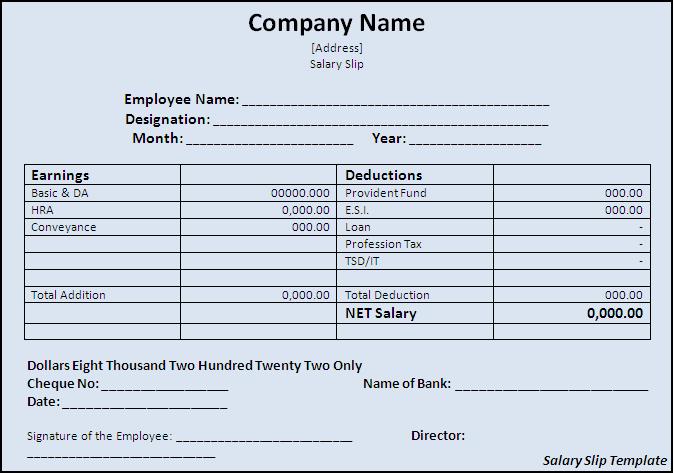

A salary slip is useful for finding new jobs and salary negotiation If your overall tax burden is below the percentage of tax previously deducted, you may be eligible for a refund. The percentage of tax deducted, if any, will also be included on your payslip. Most allowances enable you to claim a deduction up to the number of your actual costs. If you don’t have all of your data on one salary slip, all you have to do is add up the monthly amounts to get the annual totals. If your firm offers monthly aggregate information, you must do the tax calculation using the last payslip of the year. You must obtain the cumulative values for the components like basic wage, HRA, transportation allowance, medical allowance, leave travel allowance, and other components of salary for the relevant financial year from your salary slips, which are subjected to varied tax treatment. Salary slips aid in the preparation of income tax returns When you apply for a job in a company or for admission to a university or travel visa, you will typically be asked to provide work information, which will be accompanied by your monthly payslips.

Your salary slip provides evidence of employmentĪ salary payslip is a legal document that verifies your work status, job title, and monthly income amount. Some of the key advantages of salary slip are mentioned below. This will allow the employer to deduct right tax amount.Salary slips are important for a wide range of reasons.

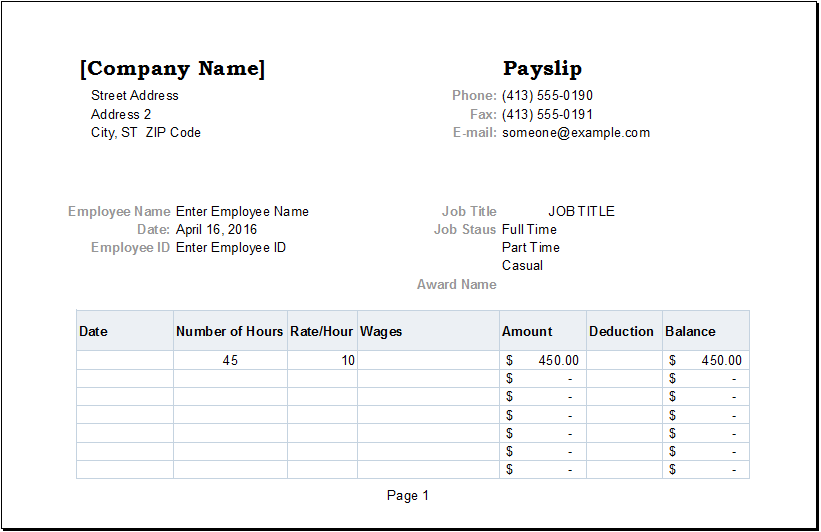

Employer/Employer Information, Pay Date, Pay Period etc.California Pay Stub Sample: New York Pay Stub Sample: Information present in Pay Stub: Even though the employee’s GROSS pay is more, NET PAY is less because of taxes, and benefits. We have given samples of pay stub of California and New York. Employees working with two different employers NET PAY will be also different for the same GROSS PAY in same state/county/city /exemptions because of the benefits offered by the employer.

The NET PAY on pay stubs (also known as pay slip or salary slip) for the same GROSS PAY for an employee working with the same employer will be different based on cities, counties, states and exemptions/deductions where the employee works because in some states there is no state tax/high state tax/less state tax.

0 kommentar(er)

0 kommentar(er)